Weekly Webinar Recap: Budgeting

- Integra Youth

- May 30, 2021

- 5 min read

Updated: Oct 11, 2021

Financial Literacy!

Throughout the centuries, humans have built up currency-based and trade-based societies. Trade is the only way to disperse goods and services when there are disparities in individual resource reserves (when there are no governments in play). If I have 7 chickens and no sugar and you have 7 kilos of sugar and no chickens, we can make the necessary trade. For example, 3 chickens for 3 kilos of sugar.

The physical trade of product for product evolved into a trade of currencies for product (some ancient currencies including sea shells, nails, copper bars). This change facilitated more equitable pricing and trading of products.

Money handling today is an infinitely more elegant thing. With our increased use of technology and countless ways in which to spend, invest or save our universal currency, it's more important than ever for individuals to be financially literate.

The week’s webinar was all about Budgeting and common financial practices. It was hosted by Raymond, the Event/Workshop host of the Teen Trillionaire. The Teen Trillionaire is a 501c3 youth led non-profit dedicated to aiding the youth population in becoming more financially literate. They’ve compiled a host of accessible, youth-geared services, including free consults, workshops, podcasts, and personal finance articles. Scroll down to the resource section for their contact information and to sign up for any of their available activities.

Raymond went over the importance of a budget, it’s construction, it’s maintenance and much more. We really recommend taking notes on this webinar!

Why we should budget

Budgets produce results and are essential in efforts to save money. Raymond outlined four main motives behind their construction. The motives are saving for post secondary, building up healthy life-long habits, being proactive/having emergencies funds and saving up for leisurely expenditures.

For many youths, the first major expense is college or university. It’s important to brace oneself for student debt and construct a plan that allows for the paying of tuition and living costs. Another reason to consider budgeting is the solidification of financial habits. Teens don’t have many options when it comes to investing or banking, but it’s never too early to build up the necessary mindset to successfully deal with mortgages, credit cards and all else in the future. Additionally, as the pandemic has shown, crises happen and it’s wise to save up in cases of emergency! The final -and possibly most incentivized - budgeting motive is saving up for fun purchases and expenses like travels.

The parts and construction of a budget

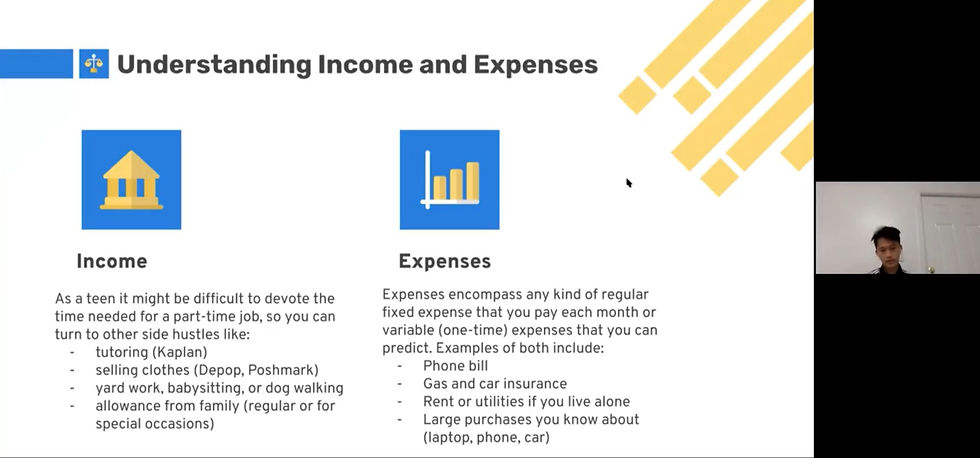

To build a budget, you must first understand all its components and the different ways your money can transform.

These parts can be a little difficult to relate to or understand under the scope of a teenager’s life. The connotation that financial literacy is an “adult thing”, and the age restrictions put on most financial services often make youths feel like understanding money is something they’re not meant to know or worry about. The Teen Trillionaire makes sure to explain all it’s concepts using situationally appropriate examples and analogies that teens can relate to!

Income & Expenses Explained

Disposable Income Explained

As Raymond mentioned, you can invest your disposable income. Let’s take a closer look at some of the options.

Stocks - Stocks are company shares. Any individual that buys shares in a publicly traded company becomes an owner of the company and can receive owner profits, called dividends, and attend shareholder meetings. When your stock price rises, you can sell your shares for a profit.

Bonds - Bonds are when individuals loan their own money to governments or companies. This is a low risk investment so the return isn’t as high as it’d be with a higher risk-investment like stocks. You’ve probably seen the government issued bond posters in history class. They were marketed towards civilians who wanted to help their current war efforts overseas. These bonds were marketed very personally known to go under names like liberty bonds, defense bonds or- when the country won- victory bonds.

Having a budget: how to maintain it, how to use it

If you've read through some of our previous webinar recaps, you'll notice that two webinars ago, one of our hosts, Dhwani, also tackled the subject of budgeting! Her topic was overall financial literacy and included in her presentation was a budgeting template perfect for students and entire households alike. To check it out, scroll down to the resource section.

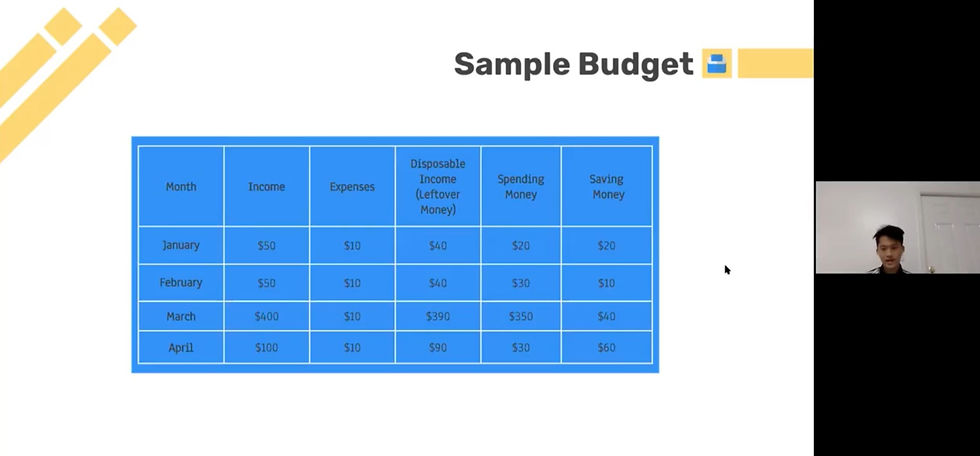

This week, in keeping with their organizational scope, Raymond and the Teen Trillionaire also provided a straight-forward budgeting template, perfect for teens.

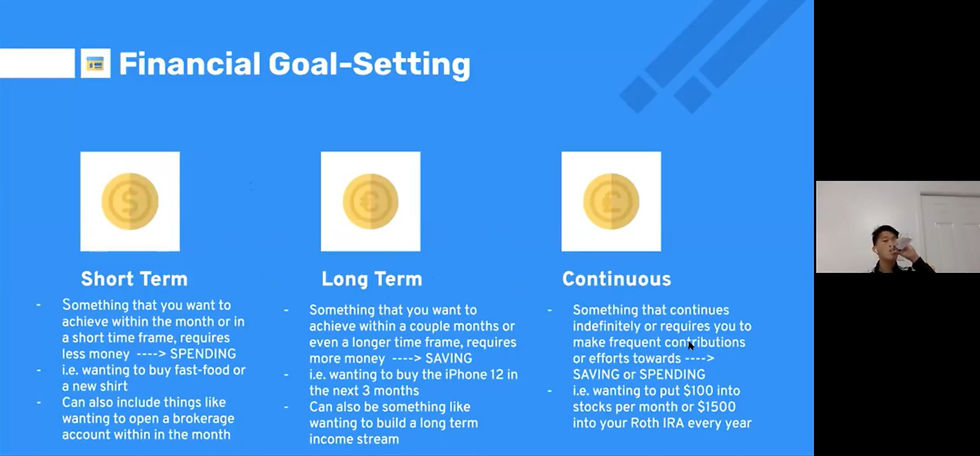

Once you've got your budget the fun begins! You can start planning realistic financial goals, using your budget as a marker indicating how much you currently have, and how you plan to distribute the money you acquire in the future.

*The Roth IRA mentioned under Continuous Financial Goal-Setting is the U.S. equivalent of a Canadian TFSA (Tax Free Savings Account) or RRSP (Registered Retirement Savings Plan)*

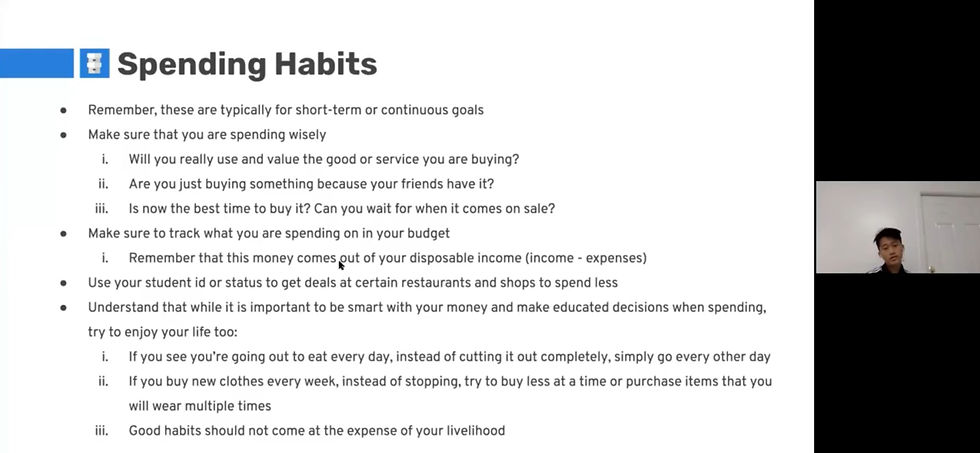

As was mentioned in the section incentivizing the creation of a budget, building up responsible spending habits and other financial habits is of utmost importance. Read through Raymond's spending habits checklist, and whenever you're about to make a purchase, consider the following things!

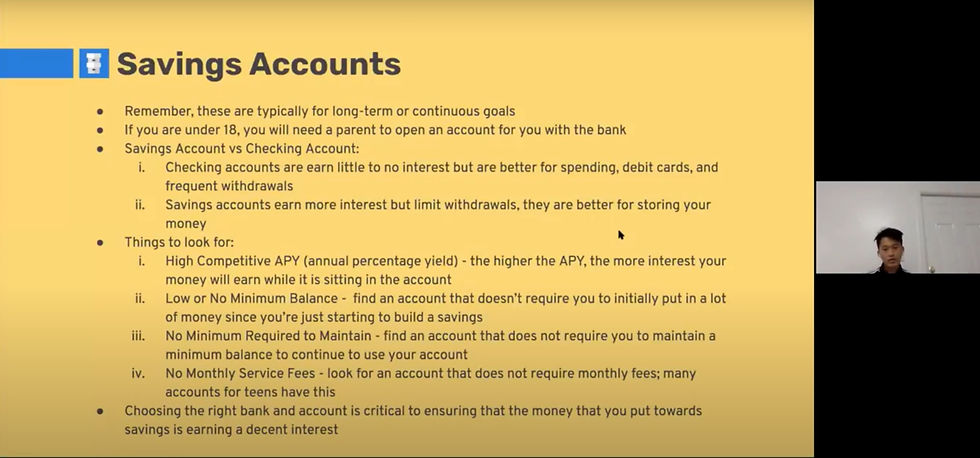

Putting your disposable income into a Savings Account is an alternative to spending it or investing it. Again, Raymond's slides perfectly summarize many of the criteria you should consider when looking for the bank and account that's the right fit for you.

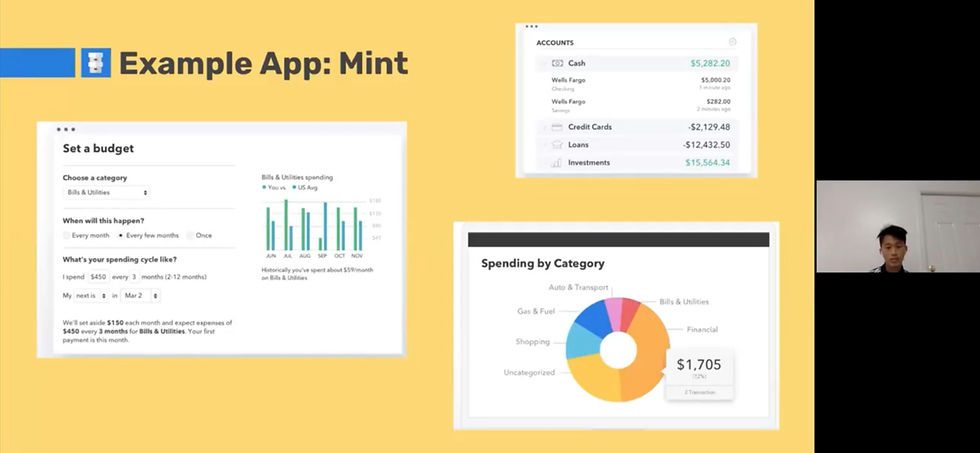

A final tip Raymond covers, is the use of apps to help you budget. Unless you really prefer budgeting on Google Sheets or Excel, an app like Mint will organize all the ways you use your disposable income, (credit cards, loans, investments) in an accessible and easy to use format. It'll give you helpful insights and ways to view your money you'd have never considered, like through pie charts helping you compare the magnitude of all your expenses.

In addition to Mint, Raymond also recommends PocketGuard and Wally.

There it is! If you identify a reason to budget, learn about all its components and pay special attention to the way you spend, invest and save, you'll be setting yourself up for financial success! And remember, you are more financially literate now than our product for product ancestral traders ever were, keep up the good work!

Resources

Ways to contact The Teen Trillionaire:

Website - www.theteentrillionaire.com

Instagram - @theteentrillionaire

Twitter - theteentrillionaire

Email - theteentrillionaire@gmail.com

(Book a session with them through email today! You can discus your personal finances or sign up for workshops.)

Budgeting Template

My Financial Future - Monthly Budget - (Make sure to make a copy of this doc in order to be able to edit)

Other Articles and resources

Comments